We all work hard to give our businesses the best chance of achieving commercial success by generating as much revenue as we can to increase our company’s bottom line. But it’s not just growing revenues that can give your bottom line an uplift.

Driving cost efficiencies through your business by decreasing procurement costs, changing products, or simply working in a different way can all save you money.

You’ve probably heard the phrase before. Put simply, cost efficiency means being able to deliver projects and services at the lowest possible price and, importantly, without compromising on the quality of your product or service.

And don’t get confused between cost efficiency and cost-effectiveness. It’s quickly done as these words are commonplace in PowerPoint presentations by eager C-Suite executives and sales managers looking to promote their business’s prowess.

But the two phrases mean entirely different things. Don’t take our word for it, take a look at the Oxford English Dictionary. According to the principal historical and definitive dictionary of the English language, the word ‘effective’ literally means having “a definitive or desired effect.” On the other hand, ‘efficient’ means ‘productive with the minimum of waste or effort.’

In short, being cost-effective is simply getting the task done and saving money without a care in the world for any detrimental ramifications to your business. Cost-efficiency helps you achieve savings by producing a product or performing an activity better. Cost efficiency considers the long-term impact on a business and aims to save money without harming outcomes to a company’s customers, its reputation, or its very existence.

Control your spending

It makes business sense to be as cost-efficient as you can. And there are many ways that this can be achieved. For starters, you need to get your spending under control and for this, you need visibility. If you haven’t a clue about what money you have coming and what money you have going out, you will struggle to get it under control. After all, you can’t measure something you can’t see. Many businesses opt for an automated central dashboard or platform, which allows you (or your finance manager) to see every payment past, present, and even scheduled. This helps you get a grip on your spending.

Stay on policy

It also helps you identify maverick spending, which is a spend that falls outside of a pre-established procurement policy and is, in essence, non-compliant. Maverick spending can be some of the most difficult spendings to locate and eradicate because it flies beneath the radar. Such spending can often be found on the statements of company credit cards or purchasing cards, which allow goods and services to be procured without using a traditional purchasing process. Without tight controls, such cards can be difficult to monitor and hard to manage. Having a system in place is vital. Businesses spend a lot of time negotiating the best price, and rogue payments can be detrimental, and impact profits or they can lead to damaging relationships with preferred suppliers.

Automate your invoicing

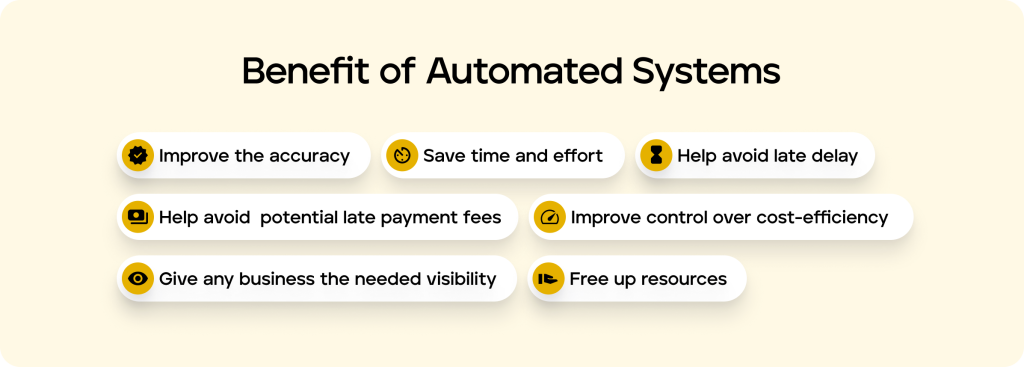

Organizing and collating numerous invoices in different in-trays, landing on different desks in different offices, is likely to be time-consuming and error-prone. It is also outdated. Businesses no longer have to rely on manual invoicing, and it makes sense to capitalize on the advantages of automated, customizable invoicing systems.

An automated system’s software can streamline the process and make it hassle-free. It will improve the accuracy of your books, save you time (and effort) and help you avoid late delays and potential late payment fees. It will free up resources that can be better deployed elsewhere. Ultimately, an automated process will help you improve your control over your cost-efficiency strategy and is transparent, giving your business the visibility, it needs.

Improve visibility

Keeping an eye on spending doesn’t only help a business keep costs under control, but increased visibility helps you plan, forecast and ensure greater compliance over any decisions you make. It’s why businesses need a reliable process for purchase management, spend analysis, cash flow control, and income maximization. An efficient procure-to-pay process flow, which is typically broken down into three primary steps that include purchase order management, document management, and invoice approval, can help you improve your business’s bottom line.

Penny offers some of the most flexible and affordable procure-to-pay solutions able to be tailored to fit your budget and stage of operation. We offer all of the above benefits and more to help you maintain an optimal relationship with suppliers and customers. Please don’t hesitate to contact us. Our team of experts is ready to answer all of your questions.