For less formal procurement functions, tail spend – or ‘indirect spend’ – can become a long-term problem that is hard to identify. But what is tail spend, and how can it be tackled?

With economic headwinds, soaring inflation, and far-flung geopolitical conflict, 2023 promises to be a year of great uncertainty for the global economy. For many businesses, being able to identify efficiency savings is a prerequisite when facing such conditions. Yet for many – particularly those that are young or informally run – it can be difficult to identify ‘tail spend’ and even harder to know how to stop it in its tracks. So, what is ’tail spend’?

Invisible Expenses

Although tail spend is called different things by different people, it typically refers to unclassified, uncontrolled, unmanaged, or rogue spending. To the finance department or manager, these expenses can be missed completely and, as such, are often ‘invisible’. And invisible spending is impossible to control.

The good news is that when these kinds of expenditures are identified and eradicated, companies gain immediate efficiencies and strong competitive advantage. They gain the ability to leverage the value of bulk orders, renegotiate contracts, put work out to competitive tender and improve supplier relationships. However, to identify where the invisible spending is, procurement managers need to learn what the different kinds of tail spends are and how the industry defines them.

Noncompliant or ‘Maverick’ Spend

Maverick spend can be some of the most difficult spending to locate and eradicate because it flies beneath the radar. It happens when payments are being made that are not managed by procurement, not under contract, and against company policy – or are non-compliant. That can include fund misappropriation. Such spends can often be found on the statements of company credit cards or purchasing cards, which allow goods and services to be procured without using a traditional purchasing process. Without tight controls, such cards can be difficult to monitor and hard to manage.

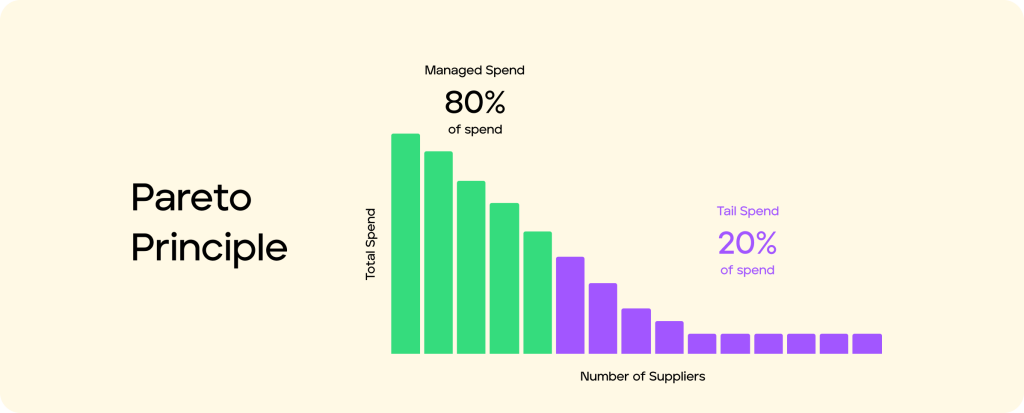

The Pareto Principle

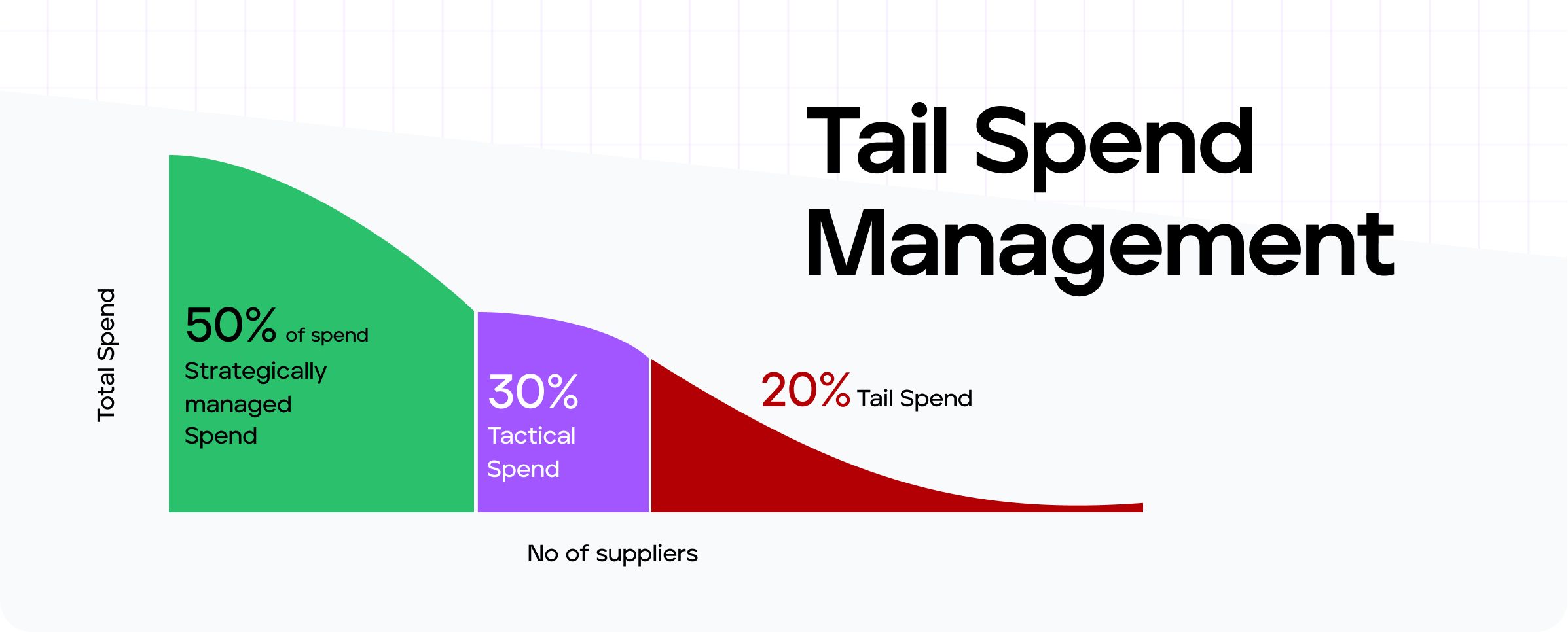

For procurement managers to comprehend how widespread tail spend might be, it can help to think about the ‘Pareto principle’ – or the 80/20 rule. It demonstrates that when companies focus on a smaller number of large, multi-year contracts that offer big top-line savings (80% of properly managed spend), there can be a tendency to ignore smaller spending arrangements. This can be called unmanaged spend, which, when ignored across a large number of vendors, can amount to as much as 20% of total spend – and become an unwieldy financial burden. Paradoxically, therefore, by ignoring ‘unmanaged’ (or smaller) spending, a company can inadvertently lose track of a majority of its vendor relationships. This can easily lead to widespread invisible spending, poorly managed vendor relationships, overpaying for services, and maverick spend.

How To Tackle Tail Spend